Personal Protect Policy ICICI Lombard

For complete information Download Brochure | Personal Protect Policy Wordings

Personal Protect

Accident! - How many times do you hear this term in a day? Unfortunately, this dreaded term is heard at least once or twice a day by each one of us. Pick up a newspaper and you will get to read at least ten cases of accidents on an average. Some of the accident victims die while others get badly injured. These people weren't expecting to die but they did! Now their families must cope with the emotional loss. This may also make them suffer a loss in the kind of lifestyle they lead. What about serious injuries? These injuries may keep you from going to work and hence, the losses.

Is there a solution? Is it possible to keep the problems away from you and your family? Yes, it is! This is exactly where a Personal Protect Insurance policy comes into play. A Personal Protect policy is a crucial element in your investment plan.

What is a Personal Protect?

Personal Protect can be referred as a policy that covers an individual for consequences in the event of an accident resulting in wide range of inconveniences.

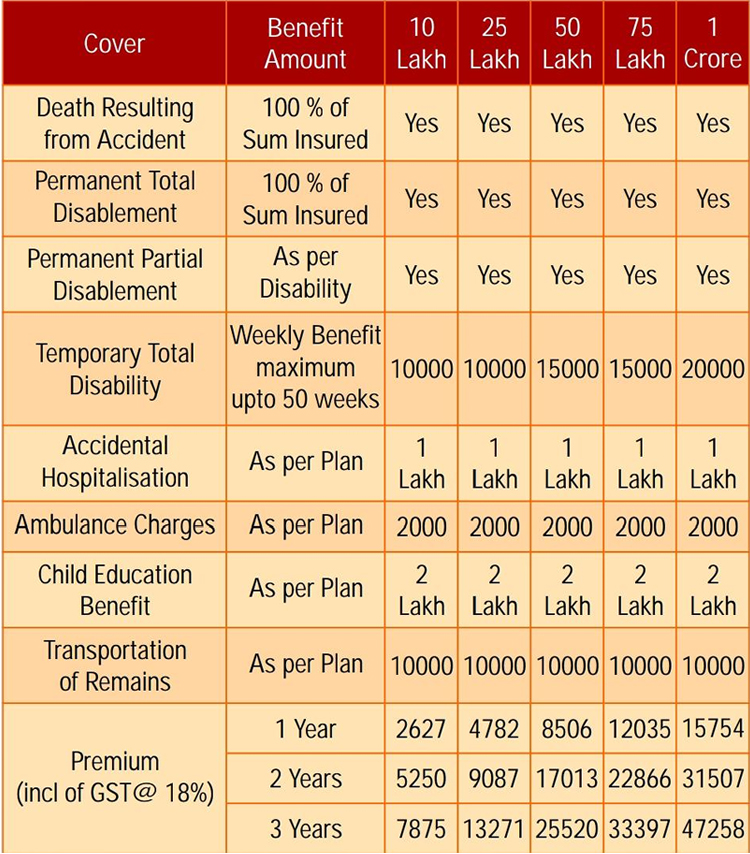

Key Benefits

- Coverage against Accidental Death or Permanent Total Disablement (PTD) due to an accident

- Optional coverage against Accidental Hospitalisation Expenses and Accidental Hospital Daily Allowance

- Customised coverage that allows you to choose upto your SI eligibility

- The policy covers different types of accidents like road, rail accidents, accidents due to natural calamities and arising out of terrorism / terrorist acts

- No health check - up required for policy issuance

- Worldwide coverage of the policy

- Easy Claim Process with minimal documentation

What is Covered?

- Accidental Death*:

In case of death of the insured due to an accident within the policy period, the nominee (mentioned in the policy) is compensated with the Sum Insured. - Permanent Total Disablement (PTD)*:

Personal Protect pays compensation against the permanent and total loss of limbs, sight etc. due to an accident. - Temporary Total Disability (TTD)

TTD Sum Insured will be paid if any injury within the policy period is the sole and direct cause of the temporary total disability (within 7 days of accident). - Accidental Hospitalization Expenses Reimbursement

The company shall reimburse the insured person for the reasonable and necessary medical expenses incurred during hospitalisation arising out of injury sustained by the insured person within 7 days of the date of Accident, during the policy period up to a maximum Sum Insured defined in the policy certificate - Ambulance Charges Extension

The company shall pay the insured person for the expenses for availing ambulance services availed for transportation of the Insured Person to the hospital from the place of accident which results in an Insured Event covered under Section A.

Children's Education Grant Extension

In the event of Death or Permanent Total Disablement suffered by the Insured Person the company shall pay a Sum Insured as mentioned in the policy certificate towards the education expenses of the dependent children of the insured - Repatriation of Remains Extension

The Company shall reimburse the costs of transporting the mortal remains of the deceased Insured Person from the place of death back to the city of residence, in the event of the death of the Insured Person (payable under Section A)

*Within 12 months from date of accident

Note

If any such injury as mentioned above shall result in the inability to remain gainfully employed, then the capital Sum Insured payable will be 100%.

What is not Covered?

The Company shall not be liable under this policy for:

- Claims arising from sickness / illness

- Death, injury or disablement of Insured as a result of below mentioned

- Intentional self - injury, suicide or attempted suicide

- While under the influence of intoxicating liquor or drugs

- While engaging in aviation or ballooning, or while mounting into, or dismounting from or travelling in any balloon or aircraft other than as a passenger (fare-paying or otherwise) in any duly licensed standard aircraft anywhere in the world

- Directly or indirectly caused by venereal disease or insanity

- Arising or resulting from the Insured committing any breach of law with criminal intent

- War, invasion, act of foreign enemy, hostilities (whether war be declared or not) civil war, rebellion, revolution, insurrection, mutiny, military or usurped power, seizure, capture, arrests, restraints and detainment of all kinds

- Nuclear weapon induced treatment

- Childbirth or pregnancy or in consequence thereof

Eligibility

The customer can buy the policy for any family member(s) i.e. spouse, dependent children or dependent parents.

- Any person between 18-65 years of age is eligible for insurance

- The proposer needs to be aged above 18 years

- Max Sum Insured shall be 10 times the annual income for salaried, 20 times the annual income for self employed and 10 Lakh in case of family members who are not involved in any active employment

Documents required: PAN Card copy, Proposal form

Significant Exclusion

The Policy does not cover losses arising out of Suicide / Attempted Suicide, Self-injury, Venereal Disease, War and Nuclear Perils and Pregnancy. For a detailed set of exclusion kindly refer policy document.

Buy Personal Protect Policy

A crucial element in your investment plan.