Professional Indemnity Insurance for Doctors & Medical Practitioners

A custom made policy designed to cover Doctors and Medical Practitioners against claim arising out of any negligent act, error or omission while rendering professional services which are below the acceptable standards set forth by the Regulatory Governing Body of the medical establishment which results in the bodily injury or death of the patient. The policy pays for the damages and defense costs arising out of a claim.

Some frequent causes of claims are

- Error in Diagnosis

- Error in treatment

- Error in any other medical procedure

A doctor when accused of professional negligence, it often becomes an expensive and time consuming issue.

A Professional Indemnity policy helps by not only reducing the financial exposure but also by bringing in the claim handling expertise available, hence reducing the time and costs involved.

*These rates are for Vertical locations only and the Geo location Kolkata

Deductible-1% of claim amount, subject to a maximum of INR 100,000 | Jurisdiction-India only

Retroactive date-inception of policy

The above terms are not available for: Plastic Surgeons | Doctors with a previous claim/loss history

Introduction

Protection for the experts, by the experts

For a patient, his doctor is someone who promises good health by putting him on the right fitness condition when an emergency lands. Unfortunately, human error cannot be eliminated and doctors are exposed to the risk of claims from clients who have suffered loss due to neglect, error or omission...

In today's litigious world, claims can pose a significant threat to the financial security for a medical practitioner. Your expertise is protecting the health of your clients. Our expertise is advising you how to protect your professional interest...

More Details

Our Professional Indemnity for Doctors Policy protects you against

- Claims arising out of bodily injury or death caused by error, omission, negligence

- Legal liability including

- Defence costs (costs, fees, expenses) incurred while investigation, cost of representation, compensation etc.

Scope of cover

This policy broadly covers:

- Bodily injury and / or death of any patient caused by or alleged to have been caused by error, omission or negligence in professional service rendered or which should have been rendered by the insured doctor

- Legal costs and expenses

Sum insured

Depending on exposure, the proposer has to fix two limits of indemnity under the policy:

- Any One Accident (AOA)

- Any One Year (AOY)

AOA and AOY can be in ratio of 1:1 or 1:2.

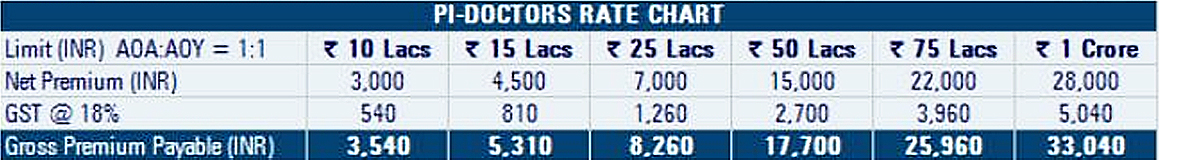

Premium

Premium chargeable depends on the:

- Risk group of doctor

- Limits of indemnity selected

- Ratio of limits

Significant exclusions

This policy does not cover liability arising out of or in connection with:

- Criminal acts

- Acts committed under Influence of intoxicants / narcotics

- Weight reduction

- Plastic surgery

- HIV / Aids

- Non compliance with statutory provisions

- Punitive and exemplary damages

- Radioactivity

- Blood Banks

Excess

To be chosen by the insured

Main Extension

- 0.25% of AOA

- India only